"I have learned how to be content with whatever I have. I know how to live on almost nothing, or with everything. I have learned the secret of living in every situation. And I have learned to be thankful, whether empty or full."

Phillipians 4:11-12

Saturday, November 24, 2018

Marshall Auerback: Apple Has an Early Case of GE’s Disease

From Naked Capitalism:

Silicon Valley stars like Apple suffer from financialization—the same ailment that felled GE and Lucent.

Silicon Valley stars like Apple suffer from financialization—the same ailment that felled GE and Lucent.

The boom witnessed in the U.S. equity market over the past few years has begun to echo the latter stages of the high tech bubble of the early 2000s, right down to the investor interest ultimately gravitating toward five stocks that have posted substantial gains, and obtained an almost cult-like status among their respective devotees. In 2002, it was Lucent, Cisco, Microsoft, Dell, and Intel. Today, it’s Facebook, Apple, Amazon, Netflix, and Google. They’ve even got an acronym among their followers: FAANG. Taken in aggregate, these five stocks account for approximately one-quarter of the NASDAQ’s total market capitalization. In fact, just three months ago, Apple alone became the first publicly traded U.S. company to reach a $1 trillion market capitalization. But just as the Big 5 of the last high tech boom ultimately came unstuck, so too, one by one, today’s tech titans are gradually being “de-FAANG-ed,” as investors have come to reassess their growth prospects on the grounds of anti-competitive/anti-trust considerations, abuse of privacy, and deteriorating top-line growth. Apple is the most recent example, but it tells a much bigger tale, which speaks to a longstanding disease infecting the overall U.S. economy: namely, financialization.

“Financialization”—which denotes “the increasing importance of financial markets, institutions and motives in the world economy”—manifests itself clearly in the case of Apple. It is becoming another example of an American company that is increasingly valuing financial engineering over real engineering, as its core businesses get hollowed out amid product saturation and declining global sales.

Like General Electric some 25 years under Jack Welch, Apple under current CEO Tim Cook increasingly represents a microcosm of the changing role of U.S. markets as they have become less a vehicle for capital provision, more akin to a wealth recycling machine in which cash piles are used less for investment/research and development, more for share buybacks (which are tied to executive compensation, elevating the incentive for, at a minimum, quarterly short-termism and, at worst, fraud and corporate looting). All in the interests of that flawed concept of “maximizing shareholder value,” in which the company’s stock price, rather than its product line, drives corporate decisions, determines senior management compensation, and becomes the ultimate measuring stick of success.

Usually, when this trend becomes ascendant, it doesn’t end well. Perhaps the adverse reaction to Apple’s recently reported earnings is the first warning of what could follow.

https://www.nakedcapitalism.com/2018/11/marshall-auerback-apple-early-case-ges-disease.html

Sunday, November 4, 2018

THE PEACE OF THE LORD THAT SURPASSES ALL UNDERSTANDING WILL GUARD YOUR HEARTS AND MINDS IN CHRIST JESUS. FINALLY, BROTHERS AND SISTERS, WHATEVER IS TRUE, WHATEVER IS HONORABLE, WHATEVER IS JUST, WHATEVER IS PURE, WHATEVER IS LOVELY, WHATEVER IS GRACIOUS, IF THERE IS ANY EXCELLENCE AND IF THERE IS ANYTHING WORTHY OF PRAISE, THINK ABOUT THESE THINGS. KEEP ON DOING WHAT YOU HAVE LEARNED AND RECEIVED AND HEARD AND SEEN IN ME. THEN THE GOD OF PEACE WILL BE WITH YOU.

PHIL 4:7-9

PHIL 4:7-9

Greenwald: Lessons From Bolsonaro's Victory in Brazil

From Jesse's Cafe:

https://jessescrossroadscafe.blogspot.com/2018/10/greenwald-lessons-from-bolsonaros.html

In the video below Glenn Greenwald discusses the recent election of Jair Bolsonaro, and what makes him substantially different from Donald Trump.

But he also ties in the dynamics that led to this election with the other recent political scenarios in Western democracies, like the US and the UK.

It is a short video and worth watching.

But he also ties in the dynamics that led to this election with the other recent political scenarios in Western democracies, like the US and the UK.

It is a short video and worth watching.

"The Right wing authoritarian Jair Bolsonaro cruised to a 10-point victory on Sunday night in Brazil, becoming president-elect of the world’s fifth most populous country and the most extremist leader in the democratic world. While some of the dynamics driving his victory are unique to Brazil, many of them are similar to prevailing political currents in North America, Eastern Europe and, increasingly, Western Europe.You may see the original at The Intercept.

Bolsonaro’s victory is highly consequential in its own right: For the 210 million people who live within the borders of the country, as well as for the region and the globe, he and his tyrannical movement now dominate. But beyond those consequences, there are valuable lessons to learn for all of the democratic world by understanding the sentiments that led Brazilians en masse to support someone who, a very short time ago, was relegated to the far fringes of political acceptability and whose ascension to power was unimaginable. I explored some of those key lessons in the eight-minute video."

Glenn Greenwald

What General Electric Is Doing to Dodge the Question: “When Will GE File for Bankruptcy?”

From Naked Capitalism:

A detailed look at GE’s fall from financial grace.

A detailed look at GE’s fall from financial grace.

Yves here. I’m old enough to remember when General Electric was widely seen as a superbly managed company and “Neutron” Jack Welch was touted as the CEO to emulate. McKinsey praised GE’s bulking up in financial services, which represented about 40% of its business in the 1990s.

Note the role that overpaying for some big deals played in General Electric’s fall.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

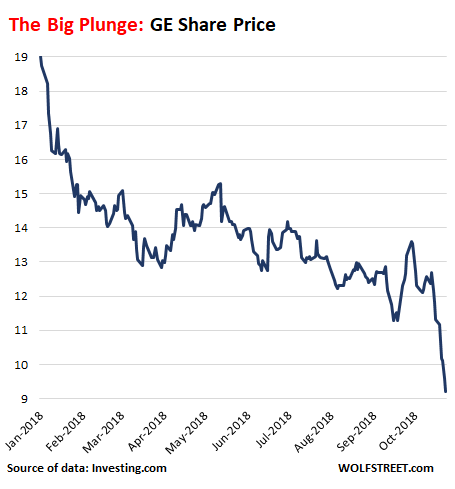

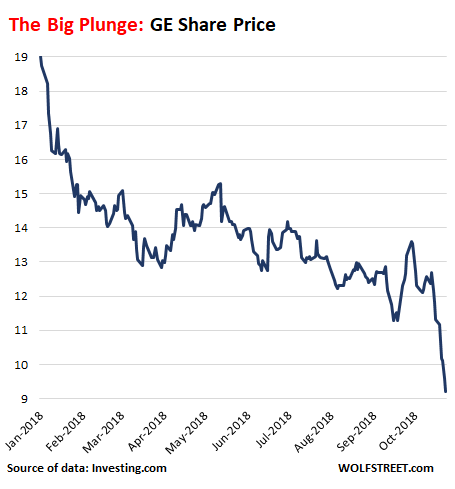

Wolf here: Shares of General Electric [GE] are down over 3% this beautiful Friday morning, trading at $9.20. If they close at this level, they would mark a new nine-year closing low. Shares are down 52% year-to-date:

The lowest close since the 1990s was $6.66 on March 5, 2009, during the Financial Crisis. I remember well: The next morning, then CEO Jeff Inmelt was on CNBC, which was owned by NBC, which was owned by GE at the time. And Inmelt was hyping GE’s shares on GE’s TV station that gave him a huge slot of time to do so, and the share price, displayed prominently onscreen, ticked up with every word he spoke.

Inmelt was also on the Board of Directors of the New York Fed, which at that time was implementing the Fed’s alphabet-soup of bailout programs for banks, industrial companies with financial divisions, money market funds, foreign central banks (dollar swap lines), and the like. This included a bailout package for GE in form of short-term loans, without which GE might have had trouble making payroll because credit had frozen up and GE had been dependent on borrowing in the corporate paper market to meet its needs, and suddenly it couldn’t. Inmelt was involved in those bailout decisions and knew what GE would get, but didn’t mention anything on CNBC.

Now Inmelt is gone from GE (resigned in 2017 “earlier than expected”), and he is gone from the New York Fed (resigned in 2011 “due to increased demands on this time”), and CNBC no longer belongs to GE, and the new CEO is trying furiously to keep the whole charade form spiraling totally out of control hoping to be able to dodge the question: “When fill GE file for bankruptcy?”

Below are some of the things that GE is doing to avoid that fate.

General Electric — at one time the world’s most formidable manufacturing company and now one of the world’s most mismanaged conglomerates — suffered more financial indignities this week: Its bond ratings got hit with back-to-back two-notch downgrades: Today by Fitch Ratings, from A to BBB+ due to the “deterioration at GE Power”; and earlier this week by Moody’s, from A2 to BAA1. This follows a similar move by Standard & Poor’s earlier in October.

https://www.nakedcapitalism.com/2018/11/general-electric-dodge-question-will-ge-file-bankruptcy.html

Subscribe to:

Comments (Atom)