"Create for me a pure heart, Lord, and renew a steadfast spirit in me. Do

not cast me from your presence or turn the Holy Spirit from me. Restore the joy

of your salvation and grant a willing spirit to sustain me. Then I will help

others to see your ways, so that your people may return back to you... You do

not desire grand gestures or burnt offerings. The sacrifice of the Lord is a

broken spirit; it is a broken and contrite heart that you, my God, will not

refuse."

Psalm 51:10-17

Sunday, April 27, 2014

Open-Source CT scanner

From Makezine:

By far the most interesting class I’ve ever taken was advanced brain imaging in graduate school, which introduced me to what I believe are some of the most amazing machines humans have ever built: the magnetic resonance imager (MRI) and computed tomography (CT) scanner. These are volumetric 3D scanners that allow you to scan not only the surface of an object, but also see inside that object. And I really wanted to build one.

These scanners are fantastically expensive, and usually only found in hospitals. As a Canadian living abroad, I recently had my first real contact with the U.S. health care system, and it was a very uncomfortable experience. Without belaboring the point, universal health care is very important to me. It’s something that many consider a basic human right, and most people in the developed world, except for the U.S., have access to it. After seeing the cost for my CT scan, I decided it was time to try to build an open source desktop CT scanner for small objects, and to do it for much less than the cost of a single scan.

Mechanically, this prototype scanner is very similar to the first generation of CT scanners, and it’s almost entirely laser cut. An object is placed on a moving table that goes through the center of a rotating ring. Inside the ring there’s a very low intensity x-ray source, and on the other side a detector. An Arduino Uno with a custom shield controls four stepper motors and interfaces with the detector. For safety I’m using a radioisotope x-ray source that’s barely above background levels, so every photon counts, and I’ve only just recalibrated the detector. I’m expecting the first images with a few more weekends of work.

I confess that I laughed and started to feel like Doc Brown when the “only” thing my CT scanner needed was something radioactive, but with luck projects like this will mature into desktop scanners for the maker community, and perhaps even medical scanners for impoverished countries, where they’re most needed.

http://makezine.com/magazine/make-38-cameras-and-av/open-source-ct-scanner/

http://makezine.com/magazine/make-38-cameras-and-av/open-source-ct-scanner/

ARM's Platform Approach to IoT Device Development

This is a presentation by Simon Ford, IoT platform director of ARM.

http://player.vimeo.com/video/88152800

Sunday, April 20, 2014

Humble yourselves under God’s hand, that he may lift you up in due time. Cast

your fears on him, because he cares for you. Be alert, and of a quiet mind.

Satan prowls like a roaring lion, looking for souls to devour. Resist him and

stand firm in the faith, because a family of believers throughout the world is

undergoing the same trials as you. And the God of all grace, who calls you to

eternal life, after you have suffered a little while, will restore you, and make

you new."

1 Peter 5:6-10

Happy Easter.

1 Peter 5:6-10

Happy Easter.

Maker Faire Shenzhen: A Seminal Event for Makers in China

Regardless of the predicaments China faces, they are making good progress in innovation, encompassing design, manufacturing, entrepreneurship, and trade. Of course, there is a global capital flow embedded in this. The global capital structure aside, Korea has to take advantage of an open approach for innovation and new business creation as well. I'm planning on attending Maker Faire in China next year.

From Makezine:

From Makezine:

Maker Faire Shenzhen, held the first weekend of April 2014, celebrated the emergence of the maker movement in China and recognized the significance of Shenzhen as a global capital for makers. In recent years, Shenzhen has attracted makers from around the world who arrive like apprentices eager to learn about manufacturing and tap into the vast resources of the Shenzhen ecosystem.

Maker Faire Shenzhen was the first full-scale Maker Faire in China. An estimated 30,000 people walked the tree-lined streets to interact with makers, participate in workshops and listen to presentations. Maker Faire Shenzhen was a showcase for 300 makers who manned 120 exhibits. Organized by Eric Pan and his team at Seeed Studio, Maker Faire Shenzhen was a public demonstration of the robust productivity of China’s makers. The maker movement could play a major role in China in transforming both China’s view of itself and the world’s view of China as a center of innovation. As a founder of Maker Faire, I was proud to see Maker Faire Shenzhen myself, participate as a speaker and learn what making means to others in China.

Maker Faire Shenzhen had its assortment of 3D printers, electronics, vehicles, games and robots, much like what you’d see at any Maker Faire. Many commented that the makers were more commercial — from the start, they saw themselves as creating a product that could be sold. Eric Pan said that he thought that more creative makers and individual projects that weren’t done for commercial reasons would come later on, as the movement matured out in China. If so, it might develop in opposite fashion from the US where the creative pursuits of hobbyist have over time developed into new business opportunities.

There were plenty of activities as well as student projects. I had two favorite student projects. One was a group of university students who had built a telepresence robot called Frank. One of the team members said that they were showing the fifth generation of Frank. The Dexta Robotics team from Nanjing showed a project that is temporarily called Handuino, which is an apparatus for your hand that allows you to control a robotic hand. The founder of the company, Aler Gu, garduated from high school last year and has taken a year off to work on this project before heading to Cambridge University in the fall to study Mechanical Engineering. Aler sees possible industrial uses for a remotely controlled hand as well as a new interface for games. They are preparing an injection-molded version of the hand soon, and then will launch a Kickstarter.

One important takeaway I had from Maker Faire Shenzhen has to do with Kickstarter. Consider this.

If you launch a product on Kickstarter, there’s a good chance that before your Kickstarter closes, someone in China will have taken your design, modified it for manufacturing and produced a version of your thing, something that will take you nearly a year or more to produce after you’ve been funded.

Now, one might think that it is just about copying or cloning. Rather, it is because the resources for making anything are so widely available in China, and the expertise is so broad, they are hungry for new ideas and they can turn them into products faster than anywhere. It is speed combined with efficiency that drives innovation in China. What happens when China’s makers start adding the kind of creativity and design that is valued in the West as a competitive advantage?

Shenzhen also has its own mindset called “shanzhai,” which several speakers addressed in presentations. Silvia Lindtner, an Austrian at UC Irvine and a co-founder of a Shanghai-base research group called HackedMatter, has been studying shanzai and sees it as a parallel development to the maker movement in China. Sylvia elaborated on shanzai in an email message.

Shanzhai is rooted in a highly distributed social network of factories, vendors, component producers, component traders, and design houses that share an approach to open sharing in many ways compatible with the global maker movement. David Li describes this as open source with Chinese characteristics; an open approach to manufacturing motivated by necessity rather than countercultural ideas. For instance, in the shanzhai ecosystem people work with open reference boards (gongban in chinese), open BOM (bill of materials) as well as open designs of form factors. This open process in manufacturing has allowed Chinese companies like Allwinner and Rockchip to innovate fast and become leaders in the non-ipad tablet market, competing with international corporations like Intel. Chinese makers and open hardware startups like Tom Cubie from Radxa are designing technologies that bridge these two spaces of open source, the shanzhai open manufacturing ecosystem and the global maker movement, enabling makers to design new products with more powerful hardware.

The biggest news for Maker Faire Shenzhen is that Foxconn sponsored the event, along with PCH International and Huaqiang, which operates the largest factory inside the city limits of Shenzhen. The Executive Chairman of Foxconn, Vincent Wang, spoke at Maker Faire. He said that his company wanted to be involved in the event and listen to makers and learn from them. His colleague, Jack Lin, said that in the past Foxconn would not work with makers but five months ago, they have opened a new business unit to focus on makers. They have also created a new fabrication facility in Beijing that can be used to prototype new products.

Companies like Intel have a significant presence in Shenzhen. Randolph Wang of Intel Labs China is developing a new product called Edison, which is a computer the size of an SD card. “Edison offers a unique combination, ” said Wang. “It is small and powerful.” Edison has the potential to be an important new platform for makers. Wang said that it can be used both for prototyping and for the final product. Wang showed a number of sample applications developed within Intel Labs China, such as a paper notebook that was powered by Edison. A demo showed a person writing a message on paper that was interpreted as an email and sent by Edison. The demo showed how a freehand drawing could be captured as image and text. Edison is not yet available but we will be watching its development closely.

http://makezine.com/2014/04/16/maker-faire-shenzhen-a-seminal-event-for-makers-in-china/

스위스식 중소기업은 없는데 스위스식 도제 교육만?

한국의

기술정책을 경제정책,

중소기업정책, 교육정책등과 결부시켜

상당한 양의

manuscript을 써 왔다.(여러가지 일을 하고 있지만 나는 기본적으로 글쟁이다. 오랫동안 사장이셨던 돌아가신 우리 아빠는 딸내미가 책 내는 것을 참 좋아하셨다.) Structural issues가 총체적으로 접근되어 해결되어야

할 것이다. 이런

맥락에서 다음의

기사는 몇

가지 중요한

포인트를 지적하고 있다.

한겨레로부터:

|

http://www.hani.co.kr/arti/economy/economy_general/632920.html

Sunday, April 6, 2014

"And Jesus wept. Then the people said, 'See how He loved him.' And others

said, 'Could he who has opened the eyes of the blind not saved him?' Jesus,

deeply moved, approached the tomb. 'Remove the stone,” he said...So they moved

the stone. Jesus looked up and said, 'Father, I thank you, and know that you

hear me. I say this so that they may also hear, and believe.' Then Jesus called

out in a loud voice, 'Lazarus, come forth!'”

John 11:35-43

John 11:35-43

Samsung SDI merges with Cheil Industries: 삼성, 전자부문 수직계열화 사실상 완성

Samsung seems to know what they are doing given the current global business environments. And yet, Samsung's move may not be necessarily good for the Korean SMEs. Korea needs to strengthen solid support industries and companies.

We are hoping to eventually become a company like Samsung, encompassing basic core technology, end products and new materials to remain competitive on a global stage. I need your prayers and support.

From the Korea Herald:

Samsung SDI, a display panel and battery maker of Samsung Group, said Monday that it would be merging with Cheil Industries.

The merger, which will make Samsung SDI the surviving entity, comes as the group seeks to create a total materials and energy solutions company.

Cheil Industries, which began as a textile maker, will dissolve 60 years after it began operations.

Samsung SDI said in a statement that it expected the new company to achieve annual sales of 10 trillion won ($9.4 billion), and that it sought to increase sales to over 29 trillion won by 2020 by generating synergy between SDI’s lithium-ion batteries and Cheil’s materials.

http://www.koreaherald.com/view.php?ud=20140331001428

한국일보로부터:

삼성그룹의 주력인 전자부문의 수직계열화가 사실상 마무리됐다. 그 동안 계속 되어온 계열사간 이합집산을 통해, 삼성전자를 정점으로 소재-부품-완제품으로 이어지는 라인업이 확실히 윤곽을 잡았다는 평가다.

삼성SDI의 현재 주력사업은 2차전지다. 원래 브라운관을 만드는 회사(옛 삼성전관)로 출발했다가, LCD PDP 등 디스플레이를 생산했으며, 현재는 휴대폰 용부터 전기자동차 용까지 다양한 형태의 2차전지를 만들고 있다. 소형 2차전지는 세계 1위다.

제일모직은 의류직물로 시작해 '빈폴'브랜드로 유명한 패션업체로 성장해 오다, 화학 및 전자소재 쪽으로 방향을 틀었다. 특히 지난해 패션부문이 삼성에버랜드로 이관되면서 소재전문업체로 남게 됐지만, 단독 회사로 키우기엔 규모와 위상이 애매하다는 지적이 많았다.

이번 합병으로 삼성SDI는 연 매출 10조원 규모의 전자 소재부품기업으로 커진다. 박상진 삼성SDI 사장은 "소재업계와 부품업계에서 각각 쌓은 양사의 전문 역량과 기술을 합해 최고의 제품과 서비스를 제공하는 초일류 소재ㆍ에너지 토탈 솔루션 기업이 될 것"이라고 밝혔다.

삼성은 수년 전부터 전자분야의 사업구조 재편 작업을 꾸준히 진행해왔다. 삼성전자가 맡았던 LCD를 떼어내 삼성디스플레이를 만들었고, 대표적 소재업체였던 삼성코닝정밀소재는 아예 코닝사에 팔았다. IT서비스업체인 삼성SDS와 삼성SNS는 통합시켰다.

이 같은 사업구조 조정을 통해 삼성의 전자부문은 보다 단순하고 명료한 수직계열체계를 갖추게 됐다. TV 휴대폰 등 완제품을 만드는 삼성전자를 정점으로, 삼성디스플레이(LCD LED OLED) 삼성SDI(2차 전지 및 관련소재) 삼성전기(각종 전자부품) 등이 핵심부품과 소재를 공급하는 그림이 만들어지게 된 것. 업계 관계자는 "결국은 삼성전자의 글로벌 경쟁력이 높아지는 효과가 생길 것"이라고 말했다.

http://media.daum.net/economic/industry/newsview?newsid=20140401033707962

We are hoping to eventually become a company like Samsung, encompassing basic core technology, end products and new materials to remain competitive on a global stage. I need your prayers and support.

From the Korea Herald:

Samsung SDI, a display panel and battery maker of Samsung Group, said Monday that it would be merging with Cheil Industries.

The merger, which will make Samsung SDI the surviving entity, comes as the group seeks to create a total materials and energy solutions company.

Cheil Industries, which began as a textile maker, will dissolve 60 years after it began operations.

Samsung SDI said in a statement that it expected the new company to achieve annual sales of 10 trillion won ($9.4 billion), and that it sought to increase sales to over 29 trillion won by 2020 by generating synergy between SDI’s lithium-ion batteries and Cheil’s materials.

http://www.koreaherald.com/view.php?ud=20140331001428

한국일보로부터:

삼성그룹의 주력인 전자부문의 수직계열화가 사실상 마무리됐다. 그 동안 계속 되어온 계열사간 이합집산을 통해, 삼성전자를 정점으로 소재-부품-완제품으로 이어지는 라인업이 확실히 윤곽을 잡았다는 평가다.

삼성SDI의 현재 주력사업은 2차전지다. 원래 브라운관을 만드는 회사(옛 삼성전관)로 출발했다가, LCD PDP 등 디스플레이를 생산했으며, 현재는 휴대폰 용부터 전기자동차 용까지 다양한 형태의 2차전지를 만들고 있다. 소형 2차전지는 세계 1위다.

제일모직은 의류직물로 시작해 '빈폴'브랜드로 유명한 패션업체로 성장해 오다, 화학 및 전자소재 쪽으로 방향을 틀었다. 특히 지난해 패션부문이 삼성에버랜드로 이관되면서 소재전문업체로 남게 됐지만, 단독 회사로 키우기엔 규모와 위상이 애매하다는 지적이 많았다.

이번 합병으로 삼성SDI는 연 매출 10조원 규모의 전자 소재부품기업으로 커진다. 박상진 삼성SDI 사장은 "소재업계와 부품업계에서 각각 쌓은 양사의 전문 역량과 기술을 합해 최고의 제품과 서비스를 제공하는 초일류 소재ㆍ에너지 토탈 솔루션 기업이 될 것"이라고 밝혔다.

삼성은 수년 전부터 전자분야의 사업구조 재편 작업을 꾸준히 진행해왔다. 삼성전자가 맡았던 LCD를 떼어내 삼성디스플레이를 만들었고, 대표적 소재업체였던 삼성코닝정밀소재는 아예 코닝사에 팔았다. IT서비스업체인 삼성SDS와 삼성SNS는 통합시켰다.

이 같은 사업구조 조정을 통해 삼성의 전자부문은 보다 단순하고 명료한 수직계열체계를 갖추게 됐다. TV 휴대폰 등 완제품을 만드는 삼성전자를 정점으로, 삼성디스플레이(LCD LED OLED) 삼성SDI(2차 전지 및 관련소재) 삼성전기(각종 전자부품) 등이 핵심부품과 소재를 공급하는 그림이 만들어지게 된 것. 업계 관계자는 "결국은 삼성전자의 글로벌 경쟁력이 높아지는 효과가 생길 것"이라고 말했다.

http://media.daum.net/economic/industry/newsview?newsid=20140401033707962

The Shocking Truth About The Deindustrialization Of America That Everyone Should Know

I have pointed out that Korea has been deindustrialized to some degree. The case of the U.S. illustrates what would happen if a nation lost its productive capacity.

From Zero Hedge:

How long can America continue to burn up wealth? How long can this nation continue to consume far more wealth than it produces? The trade deficit is one of the biggest reasons for the steady decline of the U.S. economy, but many Americans don't even understand what it is. Our current debt-fueled lifestyle is dependent on this cycle continuing. In order to live like we do, we must consume far more wealth than we produce. If someday we are forced to only live on the wealth that we create, it will require a massive adjustment in our standard of living. We have become great at consuming wealth but not so great at creating it. But as a result of running gigantic trade deficits year after year, we have lost tens of thousands of businesses, millions upon millions of jobs, and America is being deindustrialized at a staggering pace.

Just look at what has happened to manufacturing jobs in America. Back in the 1980s, more than 20 percent of the jobs in the United States were manufacturing jobs. Today, only about 9 percent of the jobs in the United States are manufacturing jobs.

And we have fewer Americans working in manufacturing today than we did in 1950 even though our population has more than doubled since then...

Many people find this statistic hard to believe, but the United States has lost a total of more than 56,000 manufacturing facilities since 2001.

http://www.zerohedge.com/news/2014-04-04/shocking-truth-about-deindustrialization-america-everyone-should-know

From Zero Hedge:

How long can America continue to burn up wealth? How long can this nation continue to consume far more wealth than it produces? The trade deficit is one of the biggest reasons for the steady decline of the U.S. economy, but many Americans don't even understand what it is. Our current debt-fueled lifestyle is dependent on this cycle continuing. In order to live like we do, we must consume far more wealth than we produce. If someday we are forced to only live on the wealth that we create, it will require a massive adjustment in our standard of living. We have become great at consuming wealth but not so great at creating it. But as a result of running gigantic trade deficits year after year, we have lost tens of thousands of businesses, millions upon millions of jobs, and America is being deindustrialized at a staggering pace.

Just look at what has happened to manufacturing jobs in America. Back in the 1980s, more than 20 percent of the jobs in the United States were manufacturing jobs. Today, only about 9 percent of the jobs in the United States are manufacturing jobs.

And we have fewer Americans working in manufacturing today than we did in 1950 even though our population has more than doubled since then...

Many people find this statistic hard to believe, but the United States has lost a total of more than 56,000 manufacturing facilities since 2001.

http://www.zerohedge.com/news/2014-04-04/shocking-truth-about-deindustrialization-america-everyone-should-know

Korea's Debt-to-GDP ratio hits 265 pct in 2013: 가계·기업·정부 빚 3천783조원…GDP의 265%

Korea is in the danger zone.

In order for innovation to play a proper role in a society, stable macroeconomic conditions are needed. Mounting debts lead to shaky consumer sector. Korea is not succeeding in making the transition from economic miracle to normal development.

From Yonhap:

Combined debt held by households, companies and the government was almost three times larger than the size of the South Korean economy last year, data showed Tuesday.

As of end-2013, debts held by economic agents amounted to 3,783,9 trillion won (US$3.58 trillion), accounting for 264.9 percent against the nominal gross domestic product (GDP). It compared with 262.5 percent tallied in 2012.

http://english.yonhapnews.co.kr/business/2014/04/02/0503000000AEN20140402002900320.html

연합뉴스로부터:

새로운 기준 적용으로 국내총생산(GDP)이 많이 늘어났음에도 한국의 가계·기업·정부의 빚은 전체 경제 규모의 3배에 육박하는 것으로 나타났다.

2004년 202.7%에서 2006년 222.5%, 2007년 229.8% 등으로 상승하더니 글로벌 금융위기를 맞은 2008년 254.4%로 훌쩍 뛰었고 2012년는 260%선으로 한단계 더 높아졌다.

정부, 기업, 가계를 가리지 않고 경제 주체들의 빚이 부가가치를 만들어내는 속도보다 더 빠르게 불어났기 때문이다.

우선 작년말 가계 및 비영리 단체의 부채는 1천223조1천억원으로 그 10년 전인 2003년의 2.3배로 늘었다.

비금융법인(민간기업+공기업·주식 및 출자지분, 직접투자 제외) 부채도 206조4천억원으로, 10년 전의 2.2배로 불었다.

특히, 정부(중앙+지방)의 부채는 496조6천억원에 달해 3.4배로 늘었다.

이 기간 새 기준 명목 GDP는 810조9천억원에서 1천428조3천억원으로 76.1% 증가하는 데 그쳤다.

http://www.yonhapnews.co.kr/economy/2014/03/31/0301000000AKR20140331216600002.HTML?template=5565

In order for innovation to play a proper role in a society, stable macroeconomic conditions are needed. Mounting debts lead to shaky consumer sector. Korea is not succeeding in making the transition from economic miracle to normal development.

From Yonhap:

Combined debt held by households, companies and the government was almost three times larger than the size of the South Korean economy last year, data showed Tuesday.

As of end-2013, debts held by economic agents amounted to 3,783,9 trillion won (US$3.58 trillion), accounting for 264.9 percent against the nominal gross domestic product (GDP). It compared with 262.5 percent tallied in 2012.

http://english.yonhapnews.co.kr/business/2014/04/02/0503000000AEN20140402002900320.html

연합뉴스로부터:

새로운 기준 적용으로 국내총생산(GDP)이 많이 늘어났음에도 한국의 가계·기업·정부의 빚은 전체 경제 규모의 3배에 육박하는 것으로 나타났다.

2004년 202.7%에서 2006년 222.5%, 2007년 229.8% 등으로 상승하더니 글로벌 금융위기를 맞은 2008년 254.4%로 훌쩍 뛰었고 2012년는 260%선으로 한단계 더 높아졌다.

정부, 기업, 가계를 가리지 않고 경제 주체들의 빚이 부가가치를 만들어내는 속도보다 더 빠르게 불어났기 때문이다.

우선 작년말 가계 및 비영리 단체의 부채는 1천223조1천억원으로 그 10년 전인 2003년의 2.3배로 늘었다.

비금융법인(민간기업+공기업·주식 및 출자지분, 직접투자 제외) 부채도 206조4천억원으로, 10년 전의 2.2배로 불었다.

특히, 정부(중앙+지방)의 부채는 496조6천억원에 달해 3.4배로 늘었다.

이 기간 새 기준 명목 GDP는 810조9천억원에서 1천428조3천억원으로 76.1% 증가하는 데 그쳤다.

http://www.yonhapnews.co.kr/economy/2014/03/31/0301000000AKR20140331216600002.HTML?template=5565

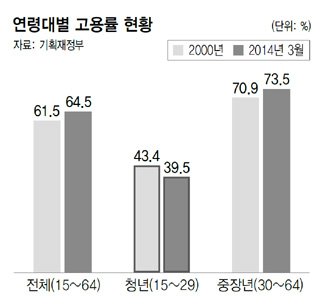

구직단념자 사상 최대..뒷전 밀린 '대졸자 고용'

korea's youth unemployment is worryingly high.

서울신문으로부터:

정부가 '고용률 70% 달성'을 추진하면서 여성과 노인의 일자리는 꾸준히 늘고 있는 반면 20~30대 청년층이 상당수를 차지하는 구직단념자는 사상 최대를 기록했다. 특히 청년실업률(20~29세)은 10%를 넘어 '대졸자 취업'이라는 고용 문제의 핵심이 뒷전으로 밀렸다는 지적이 나온다.

30일 통계청에 따르면 지난 2월 구직단념자는 26만 7000명으로 관련 통계를 산출한 1999년 11월 이후 가장 많았다. 지난달 비경제활동인구(일할 능력은 있지만 일할 의사가 없거나, 전혀 일할 능력이 없는 사람)는 1634만 6000명으로 지난해 2월보다 60만 6000명(3.6%) 줄었다. 이 중 취업의사 및 능력이 있어서 지난 1년간 구직에 나선 경험이 있었지만 일자리를 포기한 구직단념자가 지난해 2월보다 28%(7만 5000명)나 늘었다.

청년 구직단념자의 증가세가 특히 가파르다. 10개월간 줄던 구직단념자 수가 지난 1월 반등했는데 2만 5000명이 늘어나 총 23만 7000명이었다. 2만 5000명의 증가분 중 20대와 30대가 각각 8000명, 1만 1000명으로 전체의 76%였다. 지난달 20대 실업률은 10.9%로 통계를 작성한 1999년 7월 이후 최고치를 기록했다. 놀고 있는 대졸자는 2012년 12월부터 300만명을 넘어섰다. 지난달 비경제활동인구 중 대졸자의 비중은 19.25%로 5명 중 1명꼴이다. 반면 지난달 여성 취업자는 전년 동기 대비 3.9% 늘어난 1030만 1000명이었다. 같은 기간 60대 취업자는 22만 8000명이 늘어난 298만 2000명이었다.

http://www.seoul.co.kr//news/newsView.php?code=seoul&id=20140331002007

서울신문으로부터:

정부가 '고용률 70% 달성'을 추진하면서 여성과 노인의 일자리는 꾸준히 늘고 있는 반면 20~30대 청년층이 상당수를 차지하는 구직단념자는 사상 최대를 기록했다. 특히 청년실업률(20~29세)은 10%를 넘어 '대졸자 취업'이라는 고용 문제의 핵심이 뒷전으로 밀렸다는 지적이 나온다.

30일 통계청에 따르면 지난 2월 구직단념자는 26만 7000명으로 관련 통계를 산출한 1999년 11월 이후 가장 많았다. 지난달 비경제활동인구(일할 능력은 있지만 일할 의사가 없거나, 전혀 일할 능력이 없는 사람)는 1634만 6000명으로 지난해 2월보다 60만 6000명(3.6%) 줄었다. 이 중 취업의사 및 능력이 있어서 지난 1년간 구직에 나선 경험이 있었지만 일자리를 포기한 구직단념자가 지난해 2월보다 28%(7만 5000명)나 늘었다.

청년 구직단념자의 증가세가 특히 가파르다. 10개월간 줄던 구직단념자 수가 지난 1월 반등했는데 2만 5000명이 늘어나 총 23만 7000명이었다. 2만 5000명의 증가분 중 20대와 30대가 각각 8000명, 1만 1000명으로 전체의 76%였다. 지난달 20대 실업률은 10.9%로 통계를 작성한 1999년 7월 이후 최고치를 기록했다. 놀고 있는 대졸자는 2012년 12월부터 300만명을 넘어섰다. 지난달 비경제활동인구 중 대졸자의 비중은 19.25%로 5명 중 1명꼴이다. 반면 지난달 여성 취업자는 전년 동기 대비 3.9% 늘어난 1030만 1000명이었다. 같은 기간 60대 취업자는 22만 8000명이 늘어난 298만 2000명이었다.

http://www.seoul.co.kr//news/newsView.php?code=seoul&id=20140331002007

60 Minutes Sanitizes Its Report on High Frequency Trading

From Wall Street On Parade:

Two of the chief culprits of aiding and abetting high frequency traders, the New York Stock Exchange and the Nasdaq stock exchange, failed to come under scrutiny in the much heralded 60 Minutes broadcast on how the stock market is rigged.

This past Sunday night, 60 Minutes’ Steve Kroft sat down with noted author Michael Lewis to discuss his upcoming book, “Flash Boys,” and its titillating revelations about how high frequency traders are fleecing the little guy.

Kroft says to Lewis: “What’s the headline here?” Lewis responds: “Stock market’s rigged. The United States stock market, the most iconic market in global capitalism is rigged.”

Kroft then asks Lewis to state just who it is that’s rigging the market. (This is where you need to pay close attention.) Lewis responds that it’s a “combination of these stock exchanges, the big Wall Street banks and high-frequency traders.” We never hear a word more about “the big Wall Street banks” and no hint anywhere in the program that the New York Stock Exchange and Nasdaq are involved.

60 Minutes pulls a very subtle bait and switch that most likely went unnoticed by the majority of viewers. In something akin to its own “Flash Boys” maneuver, it flashes a photo of the floor of the New York Stock Exchange as Kroft says to the public that: “Michael Lewis is not talking about the stock market that you see on television every day. That ceased to be the center of U.S. financial activity years ago, and exists today mostly as a photo op.”

That statement stands in stark contrast to the harsh reality that the New York Stock Exchange is one of the key facilitators of high frequency trading and making big bucks at it....

http://wallstreetonparade.com/2014/04/60-minutes-sanitizes-its-report-on-high-frequency-trading/

Two of the chief culprits of aiding and abetting high frequency traders, the New York Stock Exchange and the Nasdaq stock exchange, failed to come under scrutiny in the much heralded 60 Minutes broadcast on how the stock market is rigged.

This past Sunday night, 60 Minutes’ Steve Kroft sat down with noted author Michael Lewis to discuss his upcoming book, “Flash Boys,” and its titillating revelations about how high frequency traders are fleecing the little guy.

Kroft says to Lewis: “What’s the headline here?” Lewis responds: “Stock market’s rigged. The United States stock market, the most iconic market in global capitalism is rigged.”

Kroft then asks Lewis to state just who it is that’s rigging the market. (This is where you need to pay close attention.) Lewis responds that it’s a “combination of these stock exchanges, the big Wall Street banks and high-frequency traders.” We never hear a word more about “the big Wall Street banks” and no hint anywhere in the program that the New York Stock Exchange and Nasdaq are involved.

60 Minutes pulls a very subtle bait and switch that most likely went unnoticed by the majority of viewers. In something akin to its own “Flash Boys” maneuver, it flashes a photo of the floor of the New York Stock Exchange as Kroft says to the public that: “Michael Lewis is not talking about the stock market that you see on television every day. That ceased to be the center of U.S. financial activity years ago, and exists today mostly as a photo op.”

That statement stands in stark contrast to the harsh reality that the New York Stock Exchange is one of the key facilitators of high frequency trading and making big bucks at it....

http://wallstreetonparade.com/2014/04/60-minutes-sanitizes-its-report-on-high-frequency-trading/

Subscribe to:

Comments (Atom)