From NYT:

South Koreans have had to deal with a series of affronts to their privacy recently, but one blow stings more than the rest: The country’s three main telecommunication companies — KT, SK Telecom and LG Uplus — have been funneling subscriber information to law enforcement agencies whenever a request is made, without demanding a warrant or informing affected customers.

They gave away names, addresses, resident registration numbers and other customer information pertaining to more than six million phone numbers in the first half of 2014 alone. All of that data now sits with law enforcement authorities, with no prospect of disposal.

The collusion between telecom firms and the state is just another item in a long list of invasions of privacy by the government since President Park Geun-hye became a contender for high office more than four years ago. Some commentators warned that Ms. Park’s election might stoke authoritarianism because of her appeal among conservatives who honor her late father, the anti-Communist dictator Park Chung-hee, but no one predicted the republic of surveillance that has taken shape under her watchful eyes.

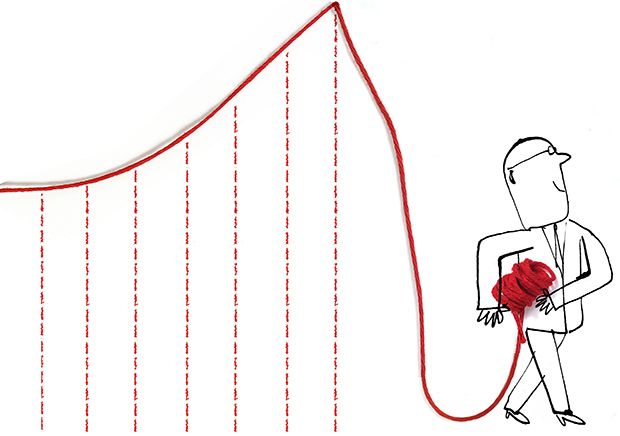

This downward spiral began during the tenure of President Lee Myung-bak, Ms. Park’s predecessor. But under this president, surveillance has reached new heights.

Initially, government monitoring was said to have something to do with reducing crime, social instability and pro-North Korean activities. But surveillance has become so commonplace that the government and the public seem to have forgotten its purpose. Policing the Internet, poring over private chats, installing an ever-increasing number of close-circuit television cameras and collecting information on telecommunication users are all part of this government’s tool kit.

In principle, Articles 17 and 18 of South Korea’s democratic Constitution prohibit the infringement of “privacy” and “privacy of correspondence.” But conservatives have sought to minimize those guarantees by invoking Article 37, which allows for curtailing rights “when necessary for national security, the maintenance of law and order or for public welfare.”

International condemnation is mounting over South Korea’s direction. Freedom House now classifies South Korea’s Internet and press freedoms as only “partly free” and has downgraded the country’s political rights rating by a notch for 2014. Amnesty International and Human Rights Watch have both called on the government to stop undermining freedom of expression, particularly in the arenas of politics and journalism.

Eventually, Ms. Park’s policies will threaten to undermine the “creative economy” she says she wants to stimulate. Her security and surveillance abuses are turning people away from the very technology companies that the country needs to stay competitive.

South Korea’s abrupt regression from a much-touted model of democracy into a land of fast-dwindling freedom is a cautionary tale even in this global age of surveillance. The erosion of privacy rights can and must be halted. We must be able to keep talking freely, even when there are those who would prefer our silence and blind submission.

http://www.nytimes.com/2015/04/03/opinion/south-koreas-invasion-of-privacy.html?_r=0