From Adafruit blog:

CNBC visited Adafruit and interviewed our founder and engineer

How one small business makes electrical engineering easy – Buzzing and humming filled the air at the Adafruit Industries factory in downtown Manhattan, where workers assembled kits for do-it-yourself electronics.

The kits, used by kids and adults alike, teach basic concepts of electrical engineering, with a reward at the end of each lesson: an original and functional item made by hand.

https://blog.adafruit.com/2015/08/30/how-one-small-business-makes-electrical-engineering-easy-by-altheadchang-cnbc/

Monday, August 31, 2015

Leveraged Financial Speculation to GDP in the US at a Familiar Peak, Once Again

From Jesse's Cafe:

"I believe myriad global “carry trades” – speculative leveraging of securities – are the unappreciated prevailing source of finance behind interlinked global securities market Bubbles. They amount to this cycle’s government-directed finance unleashed to jump-start a global reflationary cycle.

I’m convinced that perhaps Trillions worth of speculative leverage have accumulated throughout global currency and securities markets at least partially based on the perception that policymakers condone this leverage as integral (as mortgage finance was previously) in the fight against mounting global deflationary forces."

Doug Noland, Carry Trades and Trend-Following Strategies

The basic diagnosis is correct. But the nature of the disease, and the appropriate remedies, may not be so easily apprehended, except through simple common sense. And that is a rare commodity these days.

Like a dog returns to its vomit, the Fed's speculative bubble policy enables the one percent to once again feast on the carcass of the real economy.

'And no one could have ever seen it coming.'

Once is an accident.

Twice is no coincidence.

Remind yourself what has changed since then. Banks have gotten bigger. Schemes and fraud continue.

What will the third time be like? And the fourth?

Do you think that Jamie bet Lloyd a dollar that they couldn't do it again?

Should we ask them to please behave, levy some token fines, watch the politicans yell and posture in some toothless public hearings, let all of them keep their jobs and their bonuses? And then bail them out, wind up the old Victrola, and have another go at the same old thing again?

Maybe we can vote for one of their hired servants, or skip the middlemen and vote for one of the arrogant hustlers themselves, and hope they get tired of taking us for a ride before we all go broke.

This policy we have now is the trickle down stimulus that the wealthy financiers have been sucking on with every opportunity that they have made for themselves since the days of Andrew Jackson. Whenever the ability to create and distribute money has been handed over by a craven Congress to private corporations and banking cartels without sufficient oversight and regulation, excessive speculation, financial recklessness, and moral hazard have acted like a plague of misery and stagnation on the real economy.

http://jessescrossroadscafe.blogspot.kr/2015/08/leveraged-financial-speculation-in-us.html

"I believe myriad global “carry trades” – speculative leveraging of securities – are the unappreciated prevailing source of finance behind interlinked global securities market Bubbles. They amount to this cycle’s government-directed finance unleashed to jump-start a global reflationary cycle.

I’m convinced that perhaps Trillions worth of speculative leverage have accumulated throughout global currency and securities markets at least partially based on the perception that policymakers condone this leverage as integral (as mortgage finance was previously) in the fight against mounting global deflationary forces."

Doug Noland, Carry Trades and Trend-Following Strategies

The basic diagnosis is correct. But the nature of the disease, and the appropriate remedies, may not be so easily apprehended, except through simple common sense. And that is a rare commodity these days.

Like a dog returns to its vomit, the Fed's speculative bubble policy enables the one percent to once again feast on the carcass of the real economy.

'And no one could have ever seen it coming.'

Once is an accident.

Twice is no coincidence.

Remind yourself what has changed since then. Banks have gotten bigger. Schemes and fraud continue.

What will the third time be like? And the fourth?

Do you think that Jamie bet Lloyd a dollar that they couldn't do it again?

Should we ask them to please behave, levy some token fines, watch the politicans yell and posture in some toothless public hearings, let all of them keep their jobs and their bonuses? And then bail them out, wind up the old Victrola, and have another go at the same old thing again?

Maybe we can vote for one of their hired servants, or skip the middlemen and vote for one of the arrogant hustlers themselves, and hope they get tired of taking us for a ride before we all go broke.

This policy we have now is the trickle down stimulus that the wealthy financiers have been sucking on with every opportunity that they have made for themselves since the days of Andrew Jackson. Whenever the ability to create and distribute money has been handed over by a craven Congress to private corporations and banking cartels without sufficient oversight and regulation, excessive speculation, financial recklessness, and moral hazard have acted like a plague of misery and stagnation on the real economy.

"Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the Bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank.

You tell me that if I take the deposits from the Bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin!

You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, (bringing his fist down on the table) I will rout you out."

From the original minutes of the Philadelphia bankers sent to meet with President Jackson February 1834, from Andrew Jackson and the Bank of the United States (1928) by Stan V. Henkels

I believe all of the above is entirely possible. Because we still have an unashamed cadre of quack economists and their ideologically blind followers blaming the victims, prescribing harsh punishments for the weak, laying all the blame on 'government' and not corrupt officials on the payrolls of Big Money, and giving the gods of the market and their masters of the universe a big kiss on the head, and expecting them to just do the right thing the next time out of the natural goodness of their unrestrained natures the next time. What could go wrong with that?

Genuine reform. It's too much work, and too much trouble.

Related: Comprehensive Tally of Banker Fraud

h/t Jesse Felder for the chart

http://jessescrossroadscafe.blogspot.kr/2015/08/leveraged-financial-speculation-in-us.html

Did Tim Cook Lie To Save Apple Stock: The "Channel Checks" Paint A Very Gloomy Picture

From Zero Hedge:

Is AAPL the next AOL, and is Tim Cook the next Thorsten Heins? It all depends on China: if the world's most populous nation can get its stock market, its economy and its currency under control, then this too shall pass. The problem is that if, as many increasingly suggest, China has lost control of all three. At that point anyone who thought they got a great deal when buying AAPL at $92 will have far better opportunities to dollar-cost average far, far lower.

http://www.zerohedge.com/news/2015-08-29/did-tim-cook-lie-save-apple-stock-channel-checks-paint-very-gloomy-picture

Is AAPL the next AOL, and is Tim Cook the next Thorsten Heins? It all depends on China: if the world's most populous nation can get its stock market, its economy and its currency under control, then this too shall pass. The problem is that if, as many increasingly suggest, China has lost control of all three. At that point anyone who thought they got a great deal when buying AAPL at $92 will have far better opportunities to dollar-cost average far, far lower.

http://www.zerohedge.com/news/2015-08-29/did-tim-cook-lie-save-apple-stock-channel-checks-paint-very-gloomy-picture

Friday, August 28, 2015

Michael Hudson: Killing the Host, With Reckless Disregard

From Jesse's Cafe:

"In Killing the Host, economist Michael Hudson exposes how finance, insurance, and real estate, also known as the FIRE sector, have seized control of the global economy at the expense of industrial capitalism and governments. The FIRE sector is responsible for today’s extreme economic polarization, the 1% vs. the 99%, via favored tax status that inflates real estate prices while deflating the “real” economy of labor and production.

Hudson shows in vivid detail how the Great 2008 Bailout saved the banks but not the economy, and plunged the U.S., Irish, Latvian and Greek economies into debt deflation and austerity. Killing the Host describes how the phenomenon of debt deflation imposes punishing austerity on the U.S. and European economies, siphoning wealth and income upward to the financial sector while impoverishing the middle class."

I have not yet read Michael Hudson's soon to be released book Killing the Host. However we do have some highlights of his thoughts coming out of his existing body of thought which I have followed, and also in this recent interview with Democracy Now which is included below.

I cannot agree completely with Mike Hudson's take on China in this interview. No surprise, since we are two different people with different viewpoints and perspectives. I think we also are from different economic schools of thought. However I see much merit in most of what he is saying.

There was and is still a very dangerous speculative bubble and misallocation of capital that has been going on in China, that is often due to mismanagement, regulatory weakness, a surfeit of easy money, speculative fervor, and flat out corruption. While China is working to correct many of those problems, their outlook is not all sunshine and rainbows.

And I would not say that they were just 'defending themselves' by building up enormous currency reserves that just happened to come there way. I have not gone into this recently, but China took some very aggressive policy moves, including devaluing their currency against the dollar and then controlling it, and spread quite a bit of money in the right circles with regard to trade policy around Washington, to enable a mercantilist system in which they were able to build up their economy to some degree at the expense of the American middle class. Although vast fortunes were also made by some of their all too willing partners in the West as well as their own emerging class of oligarchs.

But putting that aside, the outsized financial sector in the US, which was also enabled by a big money campaign for deregulation in Washington, marked by the overturn of Glass-Steagall, has certainly spawned a significant systemic problem of corruption and malinvestment, inequality reinforced by policy, and an eroding of democracy itself.

Until steps are taken to correct this, there will be no sustainable recovery. People are fed up, and angry, and reaching for solutions some of which appear to be some rather poor choices made in extremis.

And as for the wealthy, dumb, and distracted classes, busily keeping themselves out of any meaningful discussion with the amusing distractions of the triviata of their professions, while occasionally taking a fat stipend for spewing nonsense while nursing a steady share of the vig, the consequences of all this are going to roll over them like a tsunami at midnight.

And once again, 'who could have seen it coming.'

Related: Of Bubbles and Busts: Which Way For China (Oct 2009)

"In Killing the Host, economist Michael Hudson exposes how finance, insurance, and real estate, also known as the FIRE sector, have seized control of the global economy at the expense of industrial capitalism and governments. The FIRE sector is responsible for today’s extreme economic polarization, the 1% vs. the 99%, via favored tax status that inflates real estate prices while deflating the “real” economy of labor and production.

Hudson shows in vivid detail how the Great 2008 Bailout saved the banks but not the economy, and plunged the U.S., Irish, Latvian and Greek economies into debt deflation and austerity. Killing the Host describes how the phenomenon of debt deflation imposes punishing austerity on the U.S. and European economies, siphoning wealth and income upward to the financial sector while impoverishing the middle class."

I have not yet read Michael Hudson's soon to be released book Killing the Host. However we do have some highlights of his thoughts coming out of his existing body of thought which I have followed, and also in this recent interview with Democracy Now which is included below.

I cannot agree completely with Mike Hudson's take on China in this interview. No surprise, since we are two different people with different viewpoints and perspectives. I think we also are from different economic schools of thought. However I see much merit in most of what he is saying.

There was and is still a very dangerous speculative bubble and misallocation of capital that has been going on in China, that is often due to mismanagement, regulatory weakness, a surfeit of easy money, speculative fervor, and flat out corruption. While China is working to correct many of those problems, their outlook is not all sunshine and rainbows.

And I would not say that they were just 'defending themselves' by building up enormous currency reserves that just happened to come there way. I have not gone into this recently, but China took some very aggressive policy moves, including devaluing their currency against the dollar and then controlling it, and spread quite a bit of money in the right circles with regard to trade policy around Washington, to enable a mercantilist system in which they were able to build up their economy to some degree at the expense of the American middle class. Although vast fortunes were also made by some of their all too willing partners in the West as well as their own emerging class of oligarchs.

But putting that aside, the outsized financial sector in the US, which was also enabled by a big money campaign for deregulation in Washington, marked by the overturn of Glass-Steagall, has certainly spawned a significant systemic problem of corruption and malinvestment, inequality reinforced by policy, and an eroding of democracy itself.

Until steps are taken to correct this, there will be no sustainable recovery. People are fed up, and angry, and reaching for solutions some of which appear to be some rather poor choices made in extremis.

And as for the wealthy, dumb, and distracted classes, busily keeping themselves out of any meaningful discussion with the amusing distractions of the triviata of their professions, while occasionally taking a fat stipend for spewing nonsense while nursing a steady share of the vig, the consequences of all this are going to roll over them like a tsunami at midnight.

And once again, 'who could have seen it coming.'

Related: Of Bubbles and Busts: Which Way For China (Oct 2009)

Tuesday, August 25, 2015

The Ghost Of 1997 Beckons, Can Asia Escape? Morgan Stanley, BofA Weigh In

From Zero Hedge:

The similarities between the current crisis and that which unfolded in 1997/98 were so readily apparent that many analysts began to draw comparisons and that may have added fuel to fire over the past week. Now, there seems to be a concerted effort to calm the market by explaining that while there are similarities, there are also differences. And while some of the world's imperiled EM economies may be in better shape to defend themselves this time around, when attempting to cope with a meltdown it may be more important to look at where things are similar and on that note, here’s some color from Morgan Stanley and BofAML.

http://www.zerohedge.com/news/2015-08-24/ghost-1997-beckons-can-asia-escape-morgan-stanley-bofa-weigh

The similarities between the current crisis and that which unfolded in 1997/98 were so readily apparent that many analysts began to draw comparisons and that may have added fuel to fire over the past week. Now, there seems to be a concerted effort to calm the market by explaining that while there are similarities, there are also differences. And while some of the world's imperiled EM economies may be in better shape to defend themselves this time around, when attempting to cope with a meltdown it may be more important to look at where things are similar and on that note, here’s some color from Morgan Stanley and BofAML.

http://www.zerohedge.com/news/2015-08-24/ghost-1997-beckons-can-asia-escape-morgan-stanley-bofa-weigh

Sunday, August 23, 2015

16 Startup Metrics

From Business Insider:

#1 Bookings vs. Revenue

#2 Recurring Revenue vs. Total Revenue

#3 Gross Profit

#4 Total Contract Value (TCV) vs. Annual Contract Value (ACV)

#5 LTV (Life Time Value)

#6 Gross Merchandise Value (GMV) vs. Revenue

#7 Unearned or Deferred Revenue … and Billings

#8 CAC (Customer Acquisition Cost) … Blended vs. Paid, Organic vs. Inorganic

#9 Active Users

#10 Month-on-month (MoM) growth

#11 Churn

#12 Burn Rate

#13 Downloads

#14 Cumulative Charts (vs. Growth Metrics)

#15 Chart Tricks

#16 Order of Operations

http://www.businessinsider.com/andreessen-horowitz-startup-metrics-2015-8?utm_source=dlvr.it&utm_medium=twitter

#1 Bookings vs. Revenue

#2 Recurring Revenue vs. Total Revenue

#3 Gross Profit

#4 Total Contract Value (TCV) vs. Annual Contract Value (ACV)

#5 LTV (Life Time Value)

#6 Gross Merchandise Value (GMV) vs. Revenue

#7 Unearned or Deferred Revenue … and Billings

#8 CAC (Customer Acquisition Cost) … Blended vs. Paid, Organic vs. Inorganic

#9 Active Users

#10 Month-on-month (MoM) growth

#11 Churn

#12 Burn Rate

#13 Downloads

#14 Cumulative Charts (vs. Growth Metrics)

#15 Chart Tricks

#16 Order of Operations

http://www.businessinsider.com/andreessen-horowitz-startup-metrics-2015-8?utm_source=dlvr.it&utm_medium=twitter

Jim Chanos' Dire Prediction On China: "Whatever You Might Think, It's Worse"

From Zero Hedge:

Chanos was referring to the Chinese government and more specifically to their efforts to simultaneously manage a decelerating economy, a currency devaluation, and a bursting stock market bubble.

As we’ve said on too many occasions to count, the task is quite simply impossible, a reality which often manifests itself in contradictory policy initiatives and directives emanating from Beijing. Despite the plunge protection national team’s best efforts to channel some CNY900 billion into SHCOMP large caps, China’s stock market looks to be on the verge of an outright meltdown, and the effort to support the yuan after the devaluation is draining liquidity and tightening money markets, rendering policy rate cuts less effective even as further easing becomes more necessary with every FX intervention.

In short, the situation is, as Chanos puts it, "worse than you think," and because it’s sometimes hard to get through to CNBC’s Halftime crew, Chanos reiterated the sentiment: "Whatever you might think, it's worse."

http://www.zerohedge.com/news/2015-08-22/jim-chanos-dire-prediction-china-whatever-you-might-think-its-worse

Chanos was referring to the Chinese government and more specifically to their efforts to simultaneously manage a decelerating economy, a currency devaluation, and a bursting stock market bubble.

As we’ve said on too many occasions to count, the task is quite simply impossible, a reality which often manifests itself in contradictory policy initiatives and directives emanating from Beijing. Despite the plunge protection national team’s best efforts to channel some CNY900 billion into SHCOMP large caps, China’s stock market looks to be on the verge of an outright meltdown, and the effort to support the yuan after the devaluation is draining liquidity and tightening money markets, rendering policy rate cuts less effective even as further easing becomes more necessary with every FX intervention.

In short, the situation is, as Chanos puts it, "worse than you think," and because it’s sometimes hard to get through to CNBC’s Halftime crew, Chanos reiterated the sentiment: "Whatever you might think, it's worse."

http://www.zerohedge.com/news/2015-08-22/jim-chanos-dire-prediction-china-whatever-you-might-think-its-worse

Thursday, August 20, 2015

Open-Source Modular Camera Snaps Together Like Lego

I like this kind of idea. It can be applied in more sophisticated products down the road.

From Makezine:

If you have access to a laser cutter, you can cut out and assemble modules to allow you to construct a variety of different types of cameras. By downloading the different modules you can explore all kinds of apertures, viewfinders, light benders, and film systems. The parts that aren’t laser cut are the lens and mirror. They recommend that you experiment a bit with lenses, trying things like using cheap magnifying glasses and harvesting parts from cheap zoom lenses. Here are a few examples from their site. You can see that the style can be varied quite a lot.

http://makezine.com/2015/08/19/open-source-modular-camera-snaps-together-like-lego/

From Makezine:

If you have access to a laser cutter, you can cut out and assemble modules to allow you to construct a variety of different types of cameras. By downloading the different modules you can explore all kinds of apertures, viewfinders, light benders, and film systems. The parts that aren’t laser cut are the lens and mirror. They recommend that you experiment a bit with lenses, trying things like using cheap magnifying glasses and harvesting parts from cheap zoom lenses. Here are a few examples from their site. You can see that the style can be varied quite a lot.

http://makezine.com/2015/08/19/open-source-modular-camera-snaps-together-like-lego/

Echoes Of 1997: China Devaluation "Rekindles" Asian Crisis Memories, BofA Warns

From Zero Hedge:

Even before the latest shot across the bow in the escalating global currency wars, EM FX was beset by falling commodity prices, stumbling Chinese demand, and a looming Fed hike. And while, as Barclays notes, "estimating the global effects China has via the exchange rate and growth remains a rough exercise," more than a few observers believe the effect may be to spark a Asian Financial Crisis redux. For their part, BofAML has endeavored to compare last week’s move to the 1994 renminbi devaluation, on the way to drawing comparisons between what happened in 1997 and what may unfold in the months ahead.

http://www.zerohedge.com/node/512045

Even before the latest shot across the bow in the escalating global currency wars, EM FX was beset by falling commodity prices, stumbling Chinese demand, and a looming Fed hike. And while, as Barclays notes, "estimating the global effects China has via the exchange rate and growth remains a rough exercise," more than a few observers believe the effect may be to spark a Asian Financial Crisis redux. For their part, BofAML has endeavored to compare last week’s move to the 1994 renminbi devaluation, on the way to drawing comparisons between what happened in 1997 and what may unfold in the months ahead.

http://www.zerohedge.com/node/512045

Kanbur/Stiglitz: Rent seeking as a major driver of wealth and income inequality

RFrom Naked Capitalism:

This post is wonky but important. While Stiglitz has written regularly about inequality as problematic from an economic perspective, and has mentioned rent seeking as a contributor, to my knowledge, this is the first time he’s said that old theories need to be tossed and that rent seeking is one of the main factors now driving wealth and income inequality.

http://www.nakedcapitalism.com/2015/08/kanburstiglitz-rent-seeking-as-a-major-driver-of-wealth-and-income-inequality.html

This post is wonky but important. While Stiglitz has written regularly about inequality as problematic from an economic perspective, and has mentioned rent seeking as a contributor, to my knowledge, this is the first time he’s said that old theories need to be tossed and that rent seeking is one of the main factors now driving wealth and income inequality.

http://www.nakedcapitalism.com/2015/08/kanburstiglitz-rent-seeking-as-a-major-driver-of-wealth-and-income-inequality.html

After 6 Years Of QE, And A $4.5 Trillion Balance Sheet, St. Louis Fed Admits QE Was A Mistake

From Zero Hedge:

"Evidence in support of Bernanke's view of the channels through which QE works is at best mixed. There is no work, to my knowledge, that establishes a link from QE to the ultimate goals of the Fed inflation and real economic activity. Indeed, casual evidence suggests that QE has been ineffective in increasing inflation."

http://www.zerohedge.com/news/2015-08-19/after-6-years-qe-and-45-trillion-balance-sheet-st-louis-fed-admits-qe-was-mistake

"Evidence in support of Bernanke's view of the channels through which QE works is at best mixed. There is no work, to my knowledge, that establishes a link from QE to the ultimate goals of the Fed inflation and real economic activity. Indeed, casual evidence suggests that QE has been ineffective in increasing inflation."

http://www.zerohedge.com/news/2015-08-19/after-6-years-qe-and-45-trillion-balance-sheet-st-louis-fed-admits-qe-was-mistake

Tuesday, August 18, 2015

The 8 Trillion Black Swan: Is China's Shadow Banking System About To Collapse?

From Zero Hedge:

Between micromanaging the economy, equities, the yuan, and public opinion, there's no question that China has its hands full these days. But with everyone's attention now focused sqaurely on Beijing's plunge protection team and the PBoC's "controlled" yuan devaluation, the market may be ignoring the biggest risk of all...

Between micromanaging the economy, equities, the yuan, and public opinion, there's no question that China has its hands full these days. But with everyone's attention now focused sqaurely on Beijing's plunge protection team and the PBoC's "controlled" yuan devaluation, the market may be ignoring the biggest risk of all...

Here’s the process whereby banks use trusts to get balance sheet relief:

http://www.zerohedge.com/news/2015-08-18/8-trillion-black-swan-chinas-shadow-banking-system-about-collapse

http://www.zerohedge.com/news/2015-08-18/8-trillion-black-swan-chinas-shadow-banking-system-about-collapse

Currency Carnage: Gross Warns On "Fakers And Breakers", Morgan Stanley Tells Asia To Watch Its REER

From Zero Hedge:

What does China's "surprise" move to devalue the yuan mean for "broken" EM currencies? Nothing good, Morgan Stanley says. In short, the path ahead is riddled with exported deflation and decreased trade competitiveness against a backdrop of declining global growth and trade.

...as can be seen in Exhibit 4. SGD, TWD, KRW all have over 20% of their total exports exposure and over 10% of GDP dependent on manufacturing and electronics-based exports to China. While import demand from China has already been in decline, RMB depreciation makes imports from these countries less attractive.

Here's a look at how the currencies Morgan Stanley mentions as the most exposed have performed YTD and over the past week:

http://www.zerohedge.com/news/2015-08-17/currency-carnage-gross-warns-fakers-and-breakers-morgan-stanley-tells-asia-watch-its

What does China's "surprise" move to devalue the yuan mean for "broken" EM currencies? Nothing good, Morgan Stanley says. In short, the path ahead is riddled with exported deflation and decreased trade competitiveness against a backdrop of declining global growth and trade.

...as can be seen in Exhibit 4. SGD, TWD, KRW all have over 20% of their total exports exposure and over 10% of GDP dependent on manufacturing and electronics-based exports to China. While import demand from China has already been in decline, RMB depreciation makes imports from these countries less attractive.

Here's a look at how the currencies Morgan Stanley mentions as the most exposed have performed YTD and over the past week:

http://www.zerohedge.com/news/2015-08-17/currency-carnage-gross-warns-fakers-and-breakers-morgan-stanley-tells-asia-watch-its

Monday, August 17, 2015

Driveless Trains in London

From Mish's blog:

Driverless trains are about to make a big impact in London. The Telegraph reports New 'Driverless' Tube trains unveiled by TFL.

That article is from October 2014, recently sent to me by a reader. The trains are fully automated, but will initially be manned. By the mid-2020s the trains will be totally driverless.

Driverless Train Video

Link if video does not play: London's Driverless Tube Trains.

http://globaleconomicanalysis.blogspot.kr/2015/08/driverless-trains-why-does-chicago-us.html

Driverless trains are about to make a big impact in London. The Telegraph reports New 'Driverless' Tube trains unveiled by TFL.

That article is from October 2014, recently sent to me by a reader. The trains are fully automated, but will initially be manned. By the mid-2020s the trains will be totally driverless.

Driverless Train Video

Link if video does not play: London's Driverless Tube Trains.

http://globaleconomicanalysis.blogspot.kr/2015/08/driverless-trains-why-does-chicago-us.html

Sunday, August 16, 2015

"Be strong in your faith and the power of the Truth. Put on the armor of the Lord, that you may be able to stand against the wiles of those who have given themselves over to evil. For we do not wrestle against mere flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against the spirit of wickedness in high places."

Ephesians 6:10-12

Ephesians 6:10-12

China's Debt Load To Hit 250% Of GDP In 5 Years, IMF Says

From Zero Hedge:

Anyone who follows China knows that the country faces a particularly vexing problem when it comes to debt. The way we explain it is simple: Beijing is attempting to deleverage and re-leverage simultaneously. Needless to say, this isn’t possible, but that hasn’t stopped China from trying, as is clear from the multitude of contradictory policies and directives that have emanated from Beijing over the course of the last nine months.

Admittedly, lengthy discussions about fiscal mismanagement across China’s various provincial governments doesn’t make for the most exciting reading, but it’s hugely important from a big picture perspective. Why? Here’s why:

That's from the IMF and as you can see, local government debt will account for an estimated 45% of GDP by the end of this year. If one looks at what is classified as "general government debt", China's debt-to-GDP ratio looks pretty good - especially by today's standards. Simply counting central government debt and local government bonds, the country's debt-to-GDP ratio is just a little over 20%. Thus, if you fail to include the provincial LGVF debt burden, the effect is to dramatically understate China's debt-to-GDP.

Below, find two charts from the IMF, the first showing China's actual debt-to-GDP (i.e. including LGFV financing) and another showing China's total debt-to-GDP (which includes corporate debt and which you'll note is set to hit 250% of GDP by 2020). We've also included some color from the Fund's debt sustainability analysis.

From the IMF:

Anyone who follows China knows that the country faces a particularly vexing problem when it comes to debt. The way we explain it is simple: Beijing is attempting to deleverage and re-leverage simultaneously. Needless to say, this isn’t possible, but that hasn’t stopped China from trying, as is clear from the multitude of contradictory policies and directives that have emanated from Beijing over the course of the last nine months.

Admittedly, lengthy discussions about fiscal mismanagement across China’s various provincial governments doesn’t make for the most exciting reading, but it’s hugely important from a big picture perspective. Why? Here’s why:

That's from the IMF and as you can see, local government debt will account for an estimated 45% of GDP by the end of this year. If one looks at what is classified as "general government debt", China's debt-to-GDP ratio looks pretty good - especially by today's standards. Simply counting central government debt and local government bonds, the country's debt-to-GDP ratio is just a little over 20%. Thus, if you fail to include the provincial LGVF debt burden, the effect is to dramatically understate China's debt-to-GDP.

Below, find two charts from the IMF, the first showing China's actual debt-to-GDP (i.e. including LGFV financing) and another showing China's total debt-to-GDP (which includes corporate debt and which you'll note is set to hit 250% of GDP by 2020). We've also included some color from the Fund's debt sustainability analysis.

From the IMF:

http://www.zerohedge.com/news/2015-08-15/chinas-debt-load-hit-250-gdp-5-years-imf-saysWithout reforms, growth would gradually fall to around 5 percent in 2020, with steeply increasing debt ratios.

The Real News - 9/11 The Man Who Knew Too Much

From Jesse's Cafe:

"Mass surveillance is not about protecting people; it is about social control.

The shadow government is its own enterprise, and it rewards those who pay obesiance quite richly"

Here is the second segment of a fascinating five part interview about the deep state and the mechanics of what some might call corporatism.

You may watch all five segments of this interview at The Real News here. Note that they are listed in descending order on the site, so start from the bottom up to see them in order.

"Mass surveillance is not about protecting people; it is about social control.

The shadow government is its own enterprise, and it rewards those who pay obesiance quite richly"

Here is the second segment of a fascinating five part interview about the deep state and the mechanics of what some might call corporatism.

You may watch all five segments of this interview at The Real News here. Note that they are listed in descending order on the site, so start from the bottom up to see them in order.

韓경제 산 넘어 산..中경제불안·美금리인상·신흥국위기

연합뉴스로부터:

국제금융시장과 시장정보업체 마킷에 따르면 한국의 5년 만기

외국환평형기금채권(외평채)에 붙는 신용부도스와프(CDS) 프리미엄은 지난 14일 기준 59.18bp(1bp=0.01%포인트)로 나타났다.

부도위험 지표인 한국의 CDS 프리미엄은 중국 인민은행이

위안화 전격 인하를 발표하기 직전인 지난 10일보다 6.6% 올랐다.

지난 13일에는 한국 CDS 프리미엄이 63.10bp까지

치솟아 올해 2월 12일(63.96bp) 이후 6개월여 만에 최고로 올랐다.

현재 한국의 부도 위험 지수는 현재 그렉시트(그리스의 유로존

탈퇴) 우려와 중국 주가 폭락으로 전 세계 금융시장이 패닉에 빠진 지난달 초보다도 높은 상태다.

태국, 말레이시아, 인도네시아 등 아시아 신흥국들의 부도

위험도 급등했다.

특히 인도네시아(루피아)와 말레이시아(링깃) 통화 가치는 세계

금융위기가 휘몰아친 2008년보다 낮고 1997년 동아시아 외환위기 이후 가장 낮은 수준까지 떨어졌다.

신흥국의 외환위기 가능성이 심심찮게 나오는 가운데 중국 위안화

절하를 둘러싼 잡음도 끊이지 않고 있다.

1997년 아시아 외환위기가 발생한 원인 가운데 하나로

1994년에 단행된 중국의 위안화 평가 절하 조치를 꼽는 분석도 있기 때문이다.

허재환 KDB투자증권 연구원은 "1994년 위안화가 절하된

이후 중국 무역흑자는 확대됐고 한국, 태국 등의 무역수지는 큰 폭으로 나빠졌다"며 "1994년 위안화가 절하된 후 동아시아 외환위기가

발생했다"고 지적했다.

http://media.daum.net/economic/others/newsview?newsid=20150816055612262

Emerging Market Currencies To Crash 30-50%, Jen Says

From Zero Hedge:

"[The] devaluation of the yuan risks a new round of competitive easing that may send currencies from Brazil's real to Indonesia's rupiah tumbling by an average 30 percent to 50 percent in the next nine months, according to investor and former International Monetary Fund economist Stephen Jen."

"If this is the beginning of a new phase in Beijing's currency policy, it would be the biggest development in the currency world this year,'' said Jen, founder of London-based hedge fund SLJ Macro Partners LLP. "The emerging-market currency weakening trend is now going global.''

http://www.zerohedge.com/news/2015-08-12/emerging-market-currencies-crash-30-50-jen-says

"[The] devaluation of the yuan risks a new round of competitive easing that may send currencies from Brazil's real to Indonesia's rupiah tumbling by an average 30 percent to 50 percent in the next nine months, according to investor and former International Monetary Fund economist Stephen Jen."

"If this is the beginning of a new phase in Beijing's currency policy, it would be the biggest development in the currency world this year,'' said Jen, founder of London-based hedge fund SLJ Macro Partners LLP. "The emerging-market currency weakening trend is now going global.''

http://www.zerohedge.com/news/2015-08-12/emerging-market-currencies-crash-30-50-jen-says

Tuesday, August 11, 2015

1997 Asian Currency Crisis Redux

From Zero Hedge:

This devaluation is likely not a one-time event but rather the beginning of an ongoing and persistent depreciation of the CNY versus the USD. The embedded USD short position within the carry trades will begin to result in losses and margin calls as the USD appreciates versus the CNY, thus forcing investors to liquidate some of their positions. These trades, which took years to amass, could unwind abruptly and exert an influence of historic magnitude on markets and economies.

http://www.zerohedge.com/news/2015-08-11/1997-asian-currency-crisis-redux

This devaluation is likely not a one-time event but rather the beginning of an ongoing and persistent depreciation of the CNY versus the USD. The embedded USD short position within the carry trades will begin to result in losses and margin calls as the USD appreciates versus the CNY, thus forcing investors to liquidate some of their positions. These trades, which took years to amass, could unwind abruptly and exert an influence of historic magnitude on markets and economies.

http://www.zerohedge.com/news/2015-08-11/1997-asian-currency-crisis-redux

Sunday, August 9, 2015

The Top's In" David Stockman Warns Of "Epochal Deflation"

From Zero Hedge:

The truth hurts... especially permabullish CNBC anchors. But when David Stockman explained why "the top is in," and warned that the world is overdue for an "epochal deflation, like nothing it has ever seen," one should listen. The "debt supernova" of the last decade or two has created massive over-capacity and this commodity deflation "is not temporary, it's the end of the central bank bubble." The catalyst has already happened -"It's China," Stockman exclaims, "China is the most lunatic pyramid of credit and speculation.. and capital is now fleeing the swaying towers of the China ponzi."

Well worth the price of admission...

The truth hurts... especially permabullish CNBC anchors. But when David Stockman explained why "the top is in," and warned that the world is overdue for an "epochal deflation, like nothing it has ever seen," one should listen. The "debt supernova" of the last decade or two has created massive over-capacity and this commodity deflation "is not temporary, it's the end of the central bank bubble." The catalyst has already happened -"It's China," Stockman exclaims, "China is the most lunatic pyramid of credit and speculation.. and capital is now fleeing the swaying towers of the China ponzi."

Well worth the price of admission...

Emerging Market Mayhem: Gross Warns Of "Debacle" As Currencies, Bonds Collapse

From Zero Hedge:

Things are getting downright scary in emerging markets as a "triple unwind" in credit, Chinese leverage, and loose US monetary policy wreaks havoc across the space. Between a prolonged slump in commodity prices and a structural shift towards weaker global trade, the situation could worsen materially going forward.

http://www.zerohedge.com/news/2015-08-06/emerging-market-mayhem-gross-warns-debacle-currencies-bonds-collapse

Things are getting downright scary in emerging markets as a "triple unwind" in credit, Chinese leverage, and loose US monetary policy wreaks havoc across the space. Between a prolonged slump in commodity prices and a structural shift towards weaker global trade, the situation could worsen materially going forward.

http://www.zerohedge.com/news/2015-08-06/emerging-market-mayhem-gross-warns-debacle-currencies-bonds-collapse

"영원한 승자는 없다" 중국폰에 맥 못추는 애플·삼성

노컷뉴스로부터:

국내 제조사와 애플이 맥을 못추는 사이 화웨이는 올 상반기에만 출하량 4,820만대를 기록하면서 고공행진을 하고 있다.

미국 시장조사 기관 스트래티지 애널리틱스(SA)의 최근 발표에 따르면 삼성전자는 올해 2분기 총 7,190만대의 스마트폰을 판매해 글로벌 시장에서 점유율 21%로 1위에 올랐다. 애플은 4,750만대, 점유율 14%로 2위에 올랐다.

3위부터 5위까지는 중국 제조사들이 휩쓸었다. 화웨이는 3,050만대로 9%의 점유율을 기록해 3위에 올랐으며, 샤오미는 1,980만대, 점유율 5.8%로 4위를 차지했다. 5위는 레노버-모토롤라로 판매량 1,620만대, 점유율 4.8%를 기록했다. 5위이던 LG전자는 아예 상위 5위 안에 이름을 올리지도 못했다.

삼성·LG와 애플·화웨이의 엇갈리는 행보는 또 다른 시장조사업체 카운터포인트 자료에서 더 적나라하게 드러났다. 샤오미와 화웨이가 각각 15.8%, 15.4%로 양강 체제를 형성한 가운데 애플이 12.2%로 3위를 기록했다.

◇ 中, 고스펙 프리미엄에 압도적 저가폰…애플·삼성 '다각화' 필요

◇ 中, 고스펙 프리미엄에 압도적 저가폰…애플·삼성 '다각화' 필요

애플과 삼성전자가 후발주자인 중국 스마트폰에 흔들리는 것은 스마트폰 시장이 포화된 상태에서 기술 혁신이 한계점에 다달아 더이상 경쟁력이 차별화되지 않는다는 분석이다.

실제 그동안 가격 경쟁력 중심이던 중국 제조사들은 지문인식 등의 기능을 적용하면서 애플과 삼성의 '프리미엄폰'에 버금가는 수준까지 스펙을 끌어올렸다. 세계 시장 점유율 3위까지 꿰찬 화웨이는 자체 스마트폰 관련 특허도 1만 2,000건이 넘는 등 기술력으로도 인정받고 있다.

무엇보다 중국 스마트폰은 압도적으로 저렴하다. 삼성이나 LG의 스마트폰은 아이폰보다 조금 저렴한 가격 외에는 별다른 매력이 없다. 특유의 운영체제와 매력적인 앱 생태계가 있는 것도 아니다. 비싼 돈 주고 굳이 한국제를 고집할 이유가 전혀 없게 된 것이다.

애플과 삼성이 스마트폰 이외의 수익 다각화가 시급하다는 지적이 나오는 이유다. 애플의 경우 이익의 60% 이상이 아이폰에 집중돼 '쏠림 현상'이 극심하다. 경제전문지 포브스는 "애플이 아이폰 사업에만 의존하는 것으로 세계 최고의 자리를 유지하기 어려울 것"이라며 "미래에도 아이폰의 인기가 지속된다는 보장이 없다"고 밝혔다.

Monday, August 3, 2015

"The Worldwide Credit Boom Is Over, Now Comes The Tidal Wave Of Global Deflation"

From Zero Hedge:

When we insist that markets are broken and the equities have been consigned to the gambling casinos, look no farther than today’s filing by Alpha Natural Resources. Markets, which were this wrong on a prominent name like ANRZ at the center of the global credit boom, did not make a one-time mistake; they are the mistake. As it now happens, the global credit boom is over; DM consumers are stranded at peak debt; and the China/EM investment frenzy is winding down rapidly. Now comes the tidal wave of global deflation...

But as shown below, eventually the credit bubble stops growing, materials demand flattens-out and begins to rollover, thereby causing windfall prices and profits to disappear. This happens slowly at first and then with a rush toward the drain.

ANRZ is thus rushing toward the drain because it got capitalized as if the insanely uneconomic met coal prices of 2011 would be permanent.

http://www.zerohedge.com/news/2015-08-03/worldwide-credit-boom-over-now-comes-tidal-wave-global-deflation

When we insist that markets are broken and the equities have been consigned to the gambling casinos, look no farther than today’s filing by Alpha Natural Resources. Markets, which were this wrong on a prominent name like ANRZ at the center of the global credit boom, did not make a one-time mistake; they are the mistake. As it now happens, the global credit boom is over; DM consumers are stranded at peak debt; and the China/EM investment frenzy is winding down rapidly. Now comes the tidal wave of global deflation...

But as shown below, eventually the credit bubble stops growing, materials demand flattens-out and begins to rollover, thereby causing windfall prices and profits to disappear. This happens slowly at first and then with a rush toward the drain.

ANRZ is thus rushing toward the drain because it got capitalized as if the insanely uneconomic met coal prices of 2011 would be permanent.

http://www.zerohedge.com/news/2015-08-03/worldwide-credit-boom-over-now-comes-tidal-wave-global-deflation

The Surveillance State Goes Mainstream: Windows 10 Is Watching (& Logging) Everything

From Zero Hedge:

If Edward Snowden's patriotic exposure of all things 'super secret surveillance state' in America were not enough, Newsweek reports that, as 10s of millions of hungry PC users download the free upgrade, Windows 10 is watching - and logging and sharing - everything users do... and we mean everything.

http://www.zerohedge.com/news/2015-08-02/surveillance-state-goes-mainstream-windows-10-watching-logging-everything

If Edward Snowden's patriotic exposure of all things 'super secret surveillance state' in America were not enough, Newsweek reports that, as 10s of millions of hungry PC users download the free upgrade, Windows 10 is watching - and logging and sharing - everything users do... and we mean everything.

http://www.zerohedge.com/news/2015-08-02/surveillance-state-goes-mainstream-windows-10-watching-logging-everything

Sunday, August 2, 2015

David Cay Johnston: You Can Only Push People So Far

From Jesse's Cafe:

"For decades the American financial system was stable and safe. But then something changed. The financial industry turned it's back on society, corrupted our political system and plunged the world economy into crisis. At enormous cost, we've avoided disaster and are recovering.

But the men and institutions that caused the crisis are still in power and that needs to change. They will tell us that we need them and that what they do is too complicated for us to understand. They will tell us it won't happen again. They will spend billions fighting reform. It won't be easy.

But some things are worth fighting for."Inside Job

Chinese Company Replaces Humans With Robots, Production Skyrockets, Mistakes Disappear

From Zero Hedge:

"The robots have produced almost three times as many pieces as were produced before. According to the People's Daily, production per person has increased from 8,000 pieces to 21,000 pieces. That's a 162.5% increase."

http://www.zerohedge.com/news/2015-08-01/chinese-company-replaces-humans-robots-production-skyrockets-mistakes-disappear

"The robots have produced almost three times as many pieces as were produced before. According to the People's Daily, production per person has increased from 8,000 pieces to 21,000 pieces. That's a 162.5% increase."

http://www.zerohedge.com/news/2015-08-01/chinese-company-replaces-humans-robots-production-skyrockets-mistakes-disappear

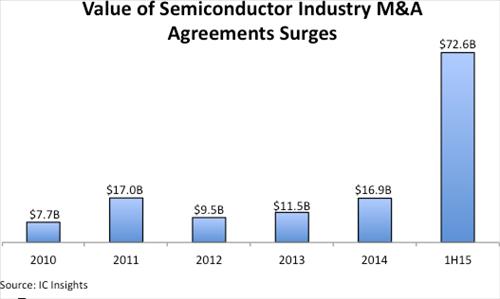

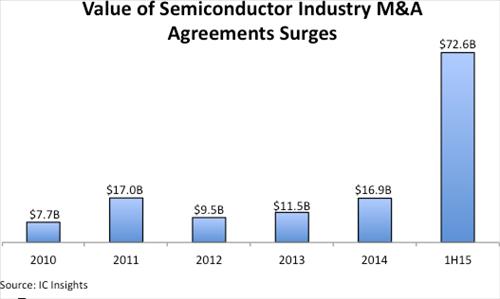

반도체업계에 'M&A 쓰나미'..상반기 합병가치 85조

연합뉴스로부터:

삼성전자 사업부문 중 반도체가 3조원이 넘는 영업이익을 올리며 버팀목 역할을 해 주목받은 가운데 글로벌 반도체 업계의 '인수합병(M&A) 쓰나미'가 심상찮은 양상이다.

31일 시장조사기관 IC인사이츠의 맥클린 보고서에 따르면 올해 상반기 반도체 산업의 M&A 활동에 의한 합병가치는 726억달러(약 85조원)에 이르는 것으로 집계됐다.

이는 2010∼2014년 연간 평균 합병가치의 약 6배에 달하는 것이다.

M&A 광풍에 기름을 부은 것은 중국 반도체 기업 쯔광그룹(紫光集團)이 세계 3위 반도체 D램 기업인 마이크론(Micron)테크놀로지(미국) 인수를 공개 제안한 '사건'이었다.

삼성전자, SK하이닉스가 1, 2위를 달리며 메모리 시장을 굳건히 지켜온 국내 반도체 업계도 칭화대 인맥을 등에 업은 쯔광그룹의 등장에 바짝 긴장하고 있다.

맥클린 보고서는 "올해는 반도체 업계의 메이저 플레이어들 사이에 퍼펙트 스톰(perfect storm, 여러가지 일이 겹쳐 발생해 파괴력을 가져온다는 의미)이 불어닥친 해"라며 "사물인터넷(IoT)이라는 엄청난 시장의 출현이 주요 반도체 업체들의 미래 전략을 리셋(재조정)함으로써 M&A 쓰나미를 몰고 왔다"고 분석했다.

oakchul@yna.co.kr

http://media.daum.net/digital/all/newsview?newsid=20150731073207401

삼성전자 사업부문 중 반도체가 3조원이 넘는 영업이익을 올리며 버팀목 역할을 해 주목받은 가운데 글로벌 반도체 업계의 '인수합병(M&A) 쓰나미'가 심상찮은 양상이다.

31일 시장조사기관 IC인사이츠의 맥클린 보고서에 따르면 올해 상반기 반도체 산업의 M&A 활동에 의한 합병가치는 726억달러(약 85조원)에 이르는 것으로 집계됐다.

이는 2010∼2014년 연간 평균 합병가치의 약 6배에 달하는 것이다.

M&A 광풍에 기름을 부은 것은 중국 반도체 기업 쯔광그룹(紫光集團)이 세계 3위 반도체 D램 기업인 마이크론(Micron)테크놀로지(미국) 인수를 공개 제안한 '사건'이었다.

삼성전자, SK하이닉스가 1, 2위를 달리며 메모리 시장을 굳건히 지켜온 국내 반도체 업계도 칭화대 인맥을 등에 업은 쯔광그룹의 등장에 바짝 긴장하고 있다.

맥클린 보고서는 "올해는 반도체 업계의 메이저 플레이어들 사이에 퍼펙트 스톰(perfect storm, 여러가지 일이 겹쳐 발생해 파괴력을 가져온다는 의미)이 불어닥친 해"라며 "사물인터넷(IoT)이라는 엄청난 시장의 출현이 주요 반도체 업체들의 미래 전략을 리셋(재조정)함으로써 M&A 쓰나미를 몰고 왔다"고 분석했다.

oakchul@yna.co.kr

http://media.daum.net/digital/all/newsview?newsid=20150731073207401

Subscribe to:

Comments (Atom)