A detailed look at GE’s fall from financial grace.

Yves here. I’m old enough to remember when General Electric was widely seen as a superbly managed company and “Neutron” Jack Welch was touted as the CEO to emulate. McKinsey praised GE’s bulking up in financial services, which represented about 40% of its business in the 1990s.

Note the role that overpaying for some big deals played in General Electric’s fall.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

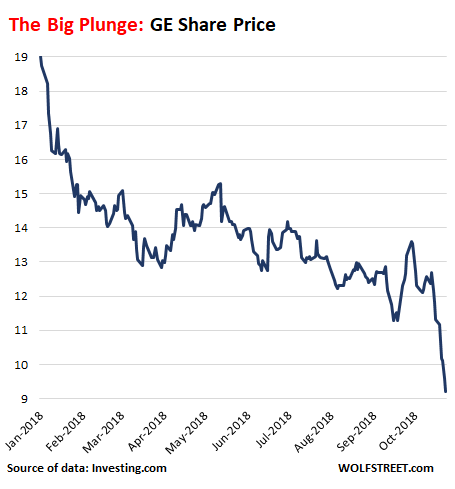

Wolf here: Shares of General Electric [GE] are down over 3% this beautiful Friday morning, trading at $9.20. If they close at this level, they would mark a new nine-year closing low. Shares are down 52% year-to-date:

The lowest close since the 1990s was $6.66 on March 5, 2009, during the Financial Crisis. I remember well: The next morning, then CEO Jeff Inmelt was on CNBC, which was owned by NBC, which was owned by GE at the time. And Inmelt was hyping GE’s shares on GE’s TV station that gave him a huge slot of time to do so, and the share price, displayed prominently onscreen, ticked up with every word he spoke.

Inmelt was also on the Board of Directors of the New York Fed, which at that time was implementing the Fed’s alphabet-soup of bailout programs for banks, industrial companies with financial divisions, money market funds, foreign central banks (dollar swap lines), and the like. This included a bailout package for GE in form of short-term loans, without which GE might have had trouble making payroll because credit had frozen up and GE had been dependent on borrowing in the corporate paper market to meet its needs, and suddenly it couldn’t. Inmelt was involved in those bailout decisions and knew what GE would get, but didn’t mention anything on CNBC.

Now Inmelt is gone from GE (resigned in 2017 “earlier than expected”), and he is gone from the New York Fed (resigned in 2011 “due to increased demands on this time”), and CNBC no longer belongs to GE, and the new CEO is trying furiously to keep the whole charade form spiraling totally out of control hoping to be able to dodge the question: “When fill GE file for bankruptcy?”

Below are some of the things that GE is doing to avoid that fate.

General Electric — at one time the world’s most formidable manufacturing company and now one of the world’s most mismanaged conglomerates — suffered more financial indignities this week: Its bond ratings got hit with back-to-back two-notch downgrades: Today by Fitch Ratings, from A to BBB+ due to the “deterioration at GE Power”; and earlier this week by Moody’s, from A2 to BAA1. This follows a similar move by Standard & Poor’s earlier in October.

https://www.nakedcapitalism.com/2018/11/general-electric-dodge-question-will-ge-file-bankruptcy.html

No comments:

Post a Comment